likelihood of capital gains tax increase in 2021

Its entirely possible that a capital gains tax hike could be passed retroactive to January 1 2021. Resident for tax purposes on H1B visa.

How Do Taxes Affect Income Inequality Tax Policy Center

Executive Summary Biden Proposal Raises Top Capital Gains Rate To 396 Ordinary Income Tax Rate Once-In-A-Lifetime Business Sales Could Trigger 396 Capital Gains Tax Biden Budget Changes To Capital Gains Rules Likely Not Effective Before 2022 Minimizing Business Owner Taxation For Near-Term Targeted Liquidity Events Business Owners Must Act.

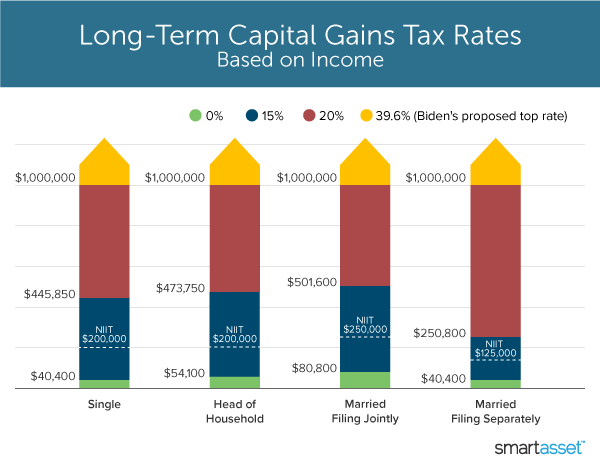

. Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year. You pay 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451.

The bank said razor-thin majorities in the House and Senate would make a big increase difficult. BMO also outperforms the TSX thus far 2021 366 versus 1935. While it is unknown what the final legislation may contain the elimination of a rate increase on capital gains in the draft legislation is encouraging.

The GOP remains resolute against. As a reminder taxes on capital gains taxes are the gains increase in income realized on the sale of a capital asset. However history tells us that isnt the most likely scenario.

Likelihood of capital gains tax increase in 2021. Will Capital Gains Tax Increase In The March 2021 Budget. I know that is a mouthful so let me break it down a.

But those thresholds may change. As a business seller if you are in either the low or mid earning bracket any proposed changes will. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion.

A retroactive change may be hard to get through congress because capital gains rates have been. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely because of the nervousness that the chancellor would bring cgt more in line with income tax but again this did not materialise. Ad Receive you refund via direct deposit.

The fast easy and 100 accurate way to file taxes online. Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a. Assuming you own 75500 worth of BMO shares in your TFSA your.

President Bidens proposal to increase the capital gains tax has generated tremendous discussion. Under this proposed tax combined federal and state taxes on capital gains would average 48 percent itself a 66 percent increase over current law exceed 50 percent in thirteen states and the District of Columbia and reach 582 percent in New York City12 The combined average federal and state capital gains would surpass Denmark Chile and France to become. Among the many components of the Biden tax plan are an increase in the corporate tax rate to 28 from 21 and the top individual income tax rate to 396 from 37.

While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change. For taxpayers with income above 1 million the long-term capital gains rate would increase to. Including that this could produce an effective long-term capital gains rate of 434 for the highest earners in the country.

The Biden tax plan would raise the top marginal income tax rate to 396 from the current 37 level. Taxes united-kingdom capital-gains-tax capital-gain. In 2020 the more income you make the higher capital gains tax rate you pay as well.

For example the Tax Foundation originally estimated that in 2021 those in the 20 th to 40 th percentiles would see a 15 percent increase in after-tax incomes on a conventional basis while the bottom 20 percent would receive about a 1 percent boost in after-tax incomes. Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman said. Capital gains tax rates.

The current long term capital gain tax is graduated. Looking at this proposed change in the context of past changes shows that both Democratic and Republican presidents have signed legislation with retroactive tax provisions. Ad Every Tax Situation Every Form - No Matter How Complicated We Have You Covered.

Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the. As one recent example the Tax Cuts and Jobs Act President Trumps tax cuts didnt go into.

Capital Gains Tax What Is It When Do You Pay It

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Capital Gains Definition 2021 Tax Rates And Examples

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

Capital Gains Definition 2021 Tax Rates And Examples

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Accelerating 2021 Business Sales To Navigate Biden S Proposed Capital Gains Tax Increase Financialadvicers In 2021 Capital Gains Tax Capital Gain Business Sales

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Capital Gains Tax In Canada Explained

Capital Gains Definition 2021 Tax Rates And Examples

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Selling Stock How Capital Gains Are Taxed The Motley Fool