unlevered free cash flow margin

Unlevered free cash flow margin. Thats not to say that all companies with low FCF margins are necessarily bad.

Matthew Hogan Blog Estimating Domino S Pizza Free Cash Flow And Intrinsic Value Talkmarkets

Net Income Per Share Diluted 005.

. Apple annual free cash flow for 2019 was 58896B a 815 decline from 2018. Unlevered Free Cash Flow 1 Yr Growth IQ_UFCF_1YR_ANN_GROWTH PEG Ratio IQ_PEG_FWD Holder Total Shares IQ_HOLDER_SHARES. ZI a global leader in modern go-to-market software data and intelligence today announced its financial results for the third quarter ended September 30 2021.

A business or asset that generates more cash than it invests provides a positive FCF that may be used to pay interest or retire debt service debt holders or to pay dividends or buy. Unlevered Free Cash Flow. During growth higher days of receivables.

Cash Flow From Operations - Capital Expenditures. Levered free cash flow is different from unlevered free cash flow because the latter assumes all capital is owned and none has been borrowed. 925000 during same period We now have the numbers needed to calculate free cash flow margin.

As another general rule a FCF margin of 10-15 is usually considered pretty good. Free Cash Flow Margin. We can see that free cash flow margin is 64.

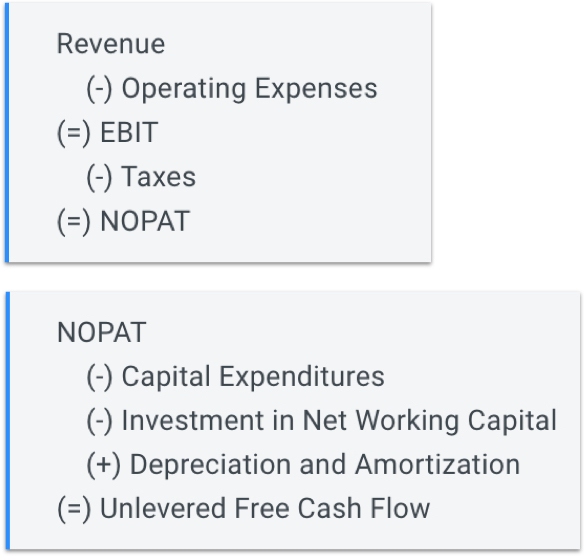

EBIT Operating income income statement t tax rate computed by dividing income taxes by EBIT. Increases unlevered free cash flows. Back to alexs point your perspective will morph if you are a banker selling this thing or whether youre a buyer trying to find good value for growth.

Apple annual free cash flow for 2021 was 92953B a 267 increase from 2020. Ive also seen people adjust public comps downward as a margin of safety. Unlevered free cash flow.

Microsoft Corporations Unlevered Free Cash Flow Margin of 299 ranks in the 947 percentile for the sector. The difference between UFCF and LFCF is the financial obligations interest and principal. 29 - 30.

Cash Flow from Operations of 465 million and Unlevered Free Cash Flow of 733 million Vancouver WA November 1 2021 - ZoomInfo NASDAQ. Apple free cash flow for the twelve months ending December 31 2021 was a year-over-year. Unlevered Free Cash Flow.

Margin tells us what portion of sales ends up as FCF. How to calculate unlevered free cash flow. Unlevered Free Cash Flow 228 422 1218 545 724 808 Change in Net.

How Do You Calculate Unlevered Free Cash Flow. Apple annual free cash flow for 2021 was 92953b a 267 increase from 2020. Our guidance is based on foreign exchange rates as of December 31 2021.

Free Cash Flow Margin. 1 56 47 Normalized Net Income Margin 50 65 68 55 53 52 Levered Free Cash Flow Margin 18 35 102 45 46 48 Unlevered Free Cash Flow Margin 22 38 105 48 56 57 Asset Turnover Total Asset Turnover 14x 13x 14x 13x 12x 11x. In some contexts this is the reality.

Increases unlevered free cash flows b. A complex provision defined in section 954c6 of the US. Therefore youll find that unlevered free cash flow is higher than levered free cash flow.

Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital. Higher margin a.

Decreases unlevered free cash flows. Unlevered free cash flow can be reported in a companys. Operating Income Margin.

Adjusted Operating Income Margin. Apple annual free cash flow for 2020 was 73365B a 2457 increase from 2019. Levered free cash flow assumes the business has debts and uses borrowed capital.

Tesla Incs Unlevered Free Cash Flow Margin of 53 ranks in. The average unlevered free cash flow margin of the companies is 37 with a standard deviation of 177. FCFF EBIT 1-t Depreciation Capital Expenditure Change in non-cash Working Capital.

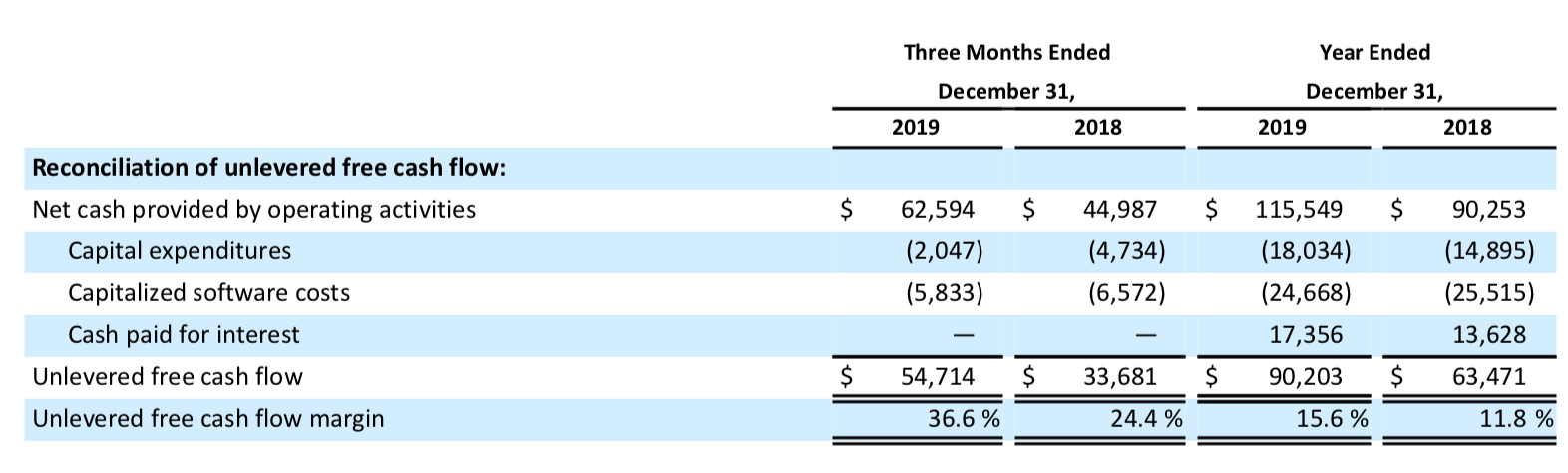

Cash Flow from Operating Activities. Over 840 companies were considered in this analysis and 428 had meaningful values. Reconciliation of non-GAAP operating income non-GAAP.

Levered free cash flow vs. Unlevered free cash flow earnings before interest tax depreciation and amortization - capital expenditures - working capital - taxes. The formula for UFCF is.

Decreases unlevered free cash flows. Discounted Cash Flow DCF Overview Weighted-Average Cost of Capital. On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made.

LFCF is usually given more importance by equity investors as they consider it a better indicator of a companys profitability. Internal Revenue Code that lowered taxes for many US. This range sort of splits the line between a capital efficient business and a capital intensive business.

Free Cash Flow margin is a ratio in which FCF is the numerator and sales is the denominator. Free Cash Flow. Does not affect unlevered free cash flows.

The unlevered free cash flow margin measures a companys unlevered free cash flow as a percentage of the revenue. Adjusted Net Income per share Diluted 014. The free cash flow yield measures the amount of cash generated from the core operations of a company relative to its valuation.

The formula to calculate the unlevered free cash flow for a company is the following. The margin will be higher for unlevered FCF than for levered if the company has any debt. Levered Free Cash Flow Margin IQ_LFCF_MARGIN EBITDA Estimate IQ_EBITDA_EST Accounts Receivable Turnover IQ_AR_TURNS EBIT Estimate IQ_EBIT_EST CIQ FUNCTIONS.

The average unlevered free cash flow margin of the companies is 52 with a standard deviation of 127. As you can see in the example above and the section highlighted in gold EBIT of 6800 less taxes of 1360 without deducting interest plus depreciation and amortization of 400 less an increase in non-cash working capital of 14000 less capital expenditures of 40400 results in unlevered free cash flow of -48560. Unlevered Free Cash Flow - UFCF.

The look thru rule gave qualifying US.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Cornerstone Ondemand It S Now About The Cash Flow Nasdaq Csod Seeking Alpha

Free Cash Flow To Firm Fcff Formulas Definition Example

Free Cash Flow To Firm Fcff Formulas Definition Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Levered Vs Unlevered Free Cash Flow Difference Wall Street Oasis

Discounted Cash Flow Analysis Street Of Walls

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Formula Formula For Free Cash Flow Examples And Guide

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition